Learn How to Register a Partnership for Successful Business Collaboration

By:Admin

[Include News Date]

[City], [State] - [Company Name], a leading provider of [industry-specific products/service] has recently announced the registration of a partnership with [Partner Company]. This strategic alliance aims to bring enhanced value and innovation to the [industry] sector, while providing a wider range of top-notch services to their esteemed customers.

With over [number] years of experience in the [industry] domain, [Company Name] has established itself as an industry leader, known for its commitment to excellence and customer satisfaction. The partnership with [Partner Company] is another significant milestone in the company's growth trajectory and reinforces its dedication to providing cutting-edge solutions to its clients.

[Partner Company], a renowned player in the [industry/business sector], shares a similar commitment to innovation and customer-centricity. The collaboration between [Company Name] and [Partner Company] is expected to tap into each company's strengths, thereby amplifying their overall capabilities and market presence.

The partnership will open doors to a wider array of services and solutions that will cater to the diverse needs of both companies' clientele. [Company Name] will leverage the technological expertise and resources of [Partner Company] to develop and deliver sophisticated products and services that meet the ever-evolving demands of the market. This collaboration will enable [Company Name] to expand its product offerings, enhance its competitiveness, and ultimately deliver greater value to its stakeholders.

By combining forces, the companies anticipate mutual growth, increased market share, and the ability to address emerging trends and challenges more effectively. The pooling of resources, knowledge, and skills will give both companies an edge in the highly competitive [industry] landscape. It will also result in improved scalability, operational efficiencies, and cost optimization that will directly benefit their customers.

Moreover, this partnership will spawn a collaborative ecosystem where both companies can engage in joint research and development efforts, driving innovation and advancing the industry as a whole. By sharing valuable insights, industry best practices, and leveraging their collective expertise, [Company Name] and [Partner Company] aim to accelerate the pace of technological advancements within the [industry] sector.

The registration of this partnership highlights [Company Name]'s commitment to maintaining its leadership position and adapting to the evolving industry landscape. By forging alliances with key players in the market, the company ensures its ability to deliver world-class solutions while remaining at the forefront of industry trends.

In conclusion, the partnership between [Company Name] and [Partner Company] signifies a strategic move that will yield substantial benefits for both companies and their customers. By combining their strengths and resources, they aim to evolve with the fast-paced industry demands, nurture innovation, and ultimately deliver unparalleled customer satisfaction. As the partnership begins to take shape, industry stakeholders eagerly anticipate the impact of this collaboration on the [industry] sector and the exciting advancements it will bring.

About [Company Name]:

[Company Name] is a leading provider of [industry-specific products/service]. With a rich history spanning over [number] years, the company has established itself as an industry leader known for its commitment to excellence and customer satisfaction. [Company Name] aims to deliver innovative solutions that address the ever-evolving needs of the market.

About [Partner Company]:

[Partner Company] is a renowned player in the [industry/business sector]. With a strong focus on technological expertise and customer-centricity, the company has built a reputation for delivering top-notch products and services. The partnership with [Company Name] signifies [Partner Company]'s commitment to mutual growth and industry advancement.

Company News & Blog

Discover the Benefits and Process of Opening a Swiss Bank Account

Title: Discover the Benefits of Opening a Swiss Bank AccountIntroduction:With a long-standing tradition of financial stability and renowned expertise in wealth management, Switzerland has established itself as the global hub for banking services. Renowned for its discretion, security, and reliability, opening a Swiss bank account offers numerous advantages for individuals and businesses alike. In this article, we will explore the benefits of opening a Swiss bank account and how it can cater to the financial needs of diverse clientele.I. Stability and Security:One of the most significant advantages of opening a Swiss bank account is the country's longstanding reputation for financial stability. Switzerland has consistently maintained a sound economy, even during global financial crises. By adhering to stringent regulations and robust supervisory frameworks, Swiss banks ensure that your funds remain secure.Swiss banks have long been synonymous with the highest standards of confidentiality and data protection. By strictly complying with Swiss banking secrecy laws, client information is safeguarded and access is largely restricted. Furthermore, Swiss banks employ state-of-the-art technology and advanced security measures, mitigating the risk of unauthorized access and cyber threats.II. Asset Protection:Swiss banks have earned a global reputation as trusted custodians of wealth, making them the ideal choice to protect and manage your assets. Whether you are an individual seeking to safeguard your savings or a company aiming to optimize international financial operations, opening a Swiss bank account provides various asset protection advantages.In Switzerland, strict legal and regulatory frameworks ensure that client assets are held separately from the bank's own assets. This separation guarantees enhanced protection against potential creditor claims or bankruptcy. Additionally, the country's political neutrality and transparent legal system contribute to the stability of your assets in the long term.III. Wealth Management Expertise:Swiss banks are renowned for their unparalleled expertise in wealth management. Thanks to their extensive experience and comprehensive range of services, Swiss banks are proficient in navigating complex financial landscapes and assisting clients in achieving their financial goals.By opening a Swiss bank account, individuals gain access to a wide variety of investment and advisory services. These offerings may include personalized portfolio management, tax optimization, estate planning, philanthropic guidance, and inheritance strategies. Clients can rely on the expertise of highly skilled professionals who understand the intricacies of global markets and tailor solutions to their unique requirements.IV. International Connectivity:Switzerland's central location in Europe and its exceptional transport and infrastructure networks make it an ideal platform for international business operations. Companies that choose to open a Swiss bank account benefit from seamless connectivity to a global network of financial markets, facilitating efficient cross-border transactions.Swiss banks provide a wide array of corporate banking services tailored to companies of all sizes. These services may include trade finance, foreign exchange transactions, cash management, and payroll administration. By utilizing the services of Swiss banks, businesses enjoy competitive advantages related to efficiency, reliability, and access to international markets.V. E-banking Solutions:Acknowledging the digital era, Swiss banks have evolved to offer cutting-edge e-banking solutions. These online platforms provide easy and secure access to your accounts, enabling you to effectively manage your finances from anywhere in the world.E-banking services offered by Swiss banks combine usability, simplicity, and state-of-the-art security measures. With secure login procedures, encrypted communication channels, and comprehensive reporting tools, clients can securely monitor their accounts, carry out transactions, and track financial performance at their convenience.Conclusion:The advantages of opening a Swiss bank account are numerous, ranging from stability and security to wealth management expertise and international connectivity. With a solid and trusted reputation, Swiss banks continue to be the preferred choice for individuals and businesses seeking financial solutions tailored to their specific needs. By embracing innovative e-banking solutions, Switzerland ensures that it remains at the forefront of global banking, catering to the evolving demands of its diverse clientele.

Comparing the Best Checking Account Offers: Find the Perfect Fit for Your Needs

Title: A Comprehensive Look at Checking Account Offers: Simplifying Banking Solutions for CustomersIntroduction:In today's fast-paced world, having a reliable and efficient banking solution is essential for individuals and businesses alike. One feature that is particularly sought after is a checking account, which allows customers to effortlessly manage their finances. In this article, we will explore the various benefits and features of checking account offers, without highlighting any specific brand, and examine how they simplify banking transactions for customers.Section 1: The Basics of Checking AccountsChecking accounts are a fundamental banking tool that offers customers a safe and convenient way to manage their everyday financial needs. Typically, these accounts come with features like check-writing capabilities, debit card access, online and mobile banking, and ATM withdrawal options. By combining these elements, checking accounts provide users with a versatile solution to conduct transactions, pay bills, and track their expenses.Section 2: Simplicity and AccessibilityChecking account offers aim to simplify banking by making it more accessible to customers. With the advent of online banking platforms, customers can now conveniently access their checking accounts anytime, anywhere. Features like online transfer options, bill payments, and mobile check deposit streamline the banking experience, eliminating the need to visit a physical branch. Additionally, many banks offer personalized customer service, allowing clients to receive assistance regarding their accounts through phone, chat, or email support.Section 3: Account Rewards and BenefitsTo enhance customer satisfaction, many checking account offers come with added rewards and benefits. These can include cashback programs, rewards points, or even annual bonuses for maintaining a certain minimum balance. By providing these incentives, banks strive to create a more appealing customer experience, ensuring that customers feel valued and motivated to continue using their checking accounts.Section 4: Overdraft Protection and Automated ServicesOne of the notable features offered by checking account programs is overdraft protection. This service protects customers from incurring additional fees when their accounts have insufficient funds, automatically transferring money from a linked savings account or line of credit. Overdraft protection ensures that customers can confidently manage their expenses while minimizing potential financial burdens.Another aspect that simplifies banking transactions is the automation of essential services. Many checking account providers offer automated bill payments, allowing customers to set up recurring payments for utilities, credit card bills, rent, and more. This feature eliminates the need to remember payment due dates, reducing the risk of missed payments and late fees.Section 5: Account Security and Fraud ProtectionChecking account offers place a strong emphasis on providing security and protection to customers. Advanced security measures, such as multi-factor authentication and real-time transaction monitoring, help detect and prevent fraudulent activity. Additionally, many banks offer zero-liability policies, ensuring that customers are not held accountable for unauthorized transactions made on their accounts.Section 6: Interest-Bearing Checking AccountsTo further incentivize customers, some banks offer interest-bearing checking accounts. These accounts allow customers to earn a nominal amount of interest on the funds deposited in their checking accounts, similar to savings accounts. Though interest rates are typically lower than in traditional savings accounts, the benefit of earning some interest on checking account balances provides an added incentive for customers to keep more money in their accounts.Conclusion:Checking account offers provide customers with convenient, secure, and simplified banking solutions. By combining an array of features such as online and mobile banking, rewards programs, overdraft protection, and automated services, these offers aim to enhance customer experience while meeting the financial needs of a wide range of customers. As banking institutions continue to innovate, the quality and accessibility of checking account offers will undoubtedly improve, providing even greater convenience and efficiency for customers around the world.

Mastering Ecommerce Accounting: A Comprehensive Guide to Streamline Your Online Business Finances

Title: Streamlining Ecommerce Accounting: A Game-Changer for BusinessesIntroduction:As the world increasingly embraces the digital realm, online businesses have witnessed unprecedented growth. Ecommerce has become the lifeline for countless entrepreneurs, offering a global reach and 24/7 accessibility. However, managing finances effectively in the ecommerce industry can be a complex endeavor, considering the vast array of transactions, payment gateways, and ever-changing regulations. Recognizing this challenge, {} is revolutionizing the ecommerce accounting landscape with its innovative platform that simplifies financial management for online businesses.Streamlining Ecommerce Accounting:{}'s cutting-edge platform has emerged as a game-changer, empowering online businesses to streamline their accounting processes. By leveraging automation and advanced software solutions, this platform enables entrepreneurs to focus on core business activities while ensuring accurate and efficient financial management. Let's explore some key features that make {} a preferred choice for ecommerce accounting.1. Automated Bookkeeping: With {}'s platform, bookkeeping becomes a breeze. It automates data entry and categorizes transactions, leaving businesses with more time to delve into strategic decision-making and growth. Automatic synchronization with popular payment gateways and sales channels ensures real-time recording of sales, fees, and expenses.2. Tax Compliance Made Easy: Complying with ever-evolving tax regulations can be overwhelming. {} simplifies this process by automatically generating financial reports tailored to tax requirements. This not only saves time but also minimizes the risk of errors, penalties, and audits.3. Inventory Management: Successful ecommerce businesses rely on efficient inventory management. {}'s accounting platform integrates seamlessly with inventory management systems, providing an accurate picture of stock levels, cost of goods sold, and profitability. This ensures optimal inventory control and helps businesses avoid stockouts or overstocking.4. Multichannel Integration: Online businesses often operate across multiple sales channels, including marketplaces and social media platforms. {} integrates with these channels, consolidating financial data in one centralized location. This enables businesses to gain holistic insights into their performance, identify trends, and make data-driven decisions.5. Financial Reporting and Analytics: {} offers comprehensive financial reporting tools, equipping businesses with key performance indicators, cash flow statements, profit and loss statements, and customizable reports. These analytical insights provide a clear understanding of the financial health of the business, facilitating informed decision-making.6. Secure and Scalable Solution: {} recognizes the importance of data security and offers a highly secure environment to safeguard financial information. Its cloud-based architecture ensures reliable access to data from anywhere, anytime. Additionally, the platform is designed to handle the growing needs of businesses, allowing for scalability as the company expands.Conclusion:In the fiercely competitive world of ecommerce, efficient accounting practices are paramount to success. By combining innovative technology with user-friendly design, {} empowers online businesses to focus on growth while ensuring accurate financial management. From automated bookkeeping to tax compliance, inventory management to multichannel integration, {} offers a comprehensive solution tailored to the unique needs of ecommerce businesses. With {} at their side, entrepreneurs can embrace the digital landscape confidently, knowing their financials are in safe hands.

Listing Essential Steps for Business Name Registration

Title: Business Name Registration Simplified: A Step towards Successful Company EstablishmentIntroduction:In an effort to streamline business operations and foster entrepreneurial growth, the government has announced a simplified process for business name registration. This move aims to remove the hassle associated with registering brand names for startups, as well as encouraging more individuals to embark on their entrepreneurial journey.The new policy, implemented by regulatory authorities and overseen by the Business Registration Office, will help businesses register their names with ease and efficiency. By reducing bureaucratic obstacles, the government hopes to foster a vibrant and inclusive business ecosystem.1. Hassle-free Business Name Registration Process:Under the new guidelines, the business name registration process has been simplified significantly. Entrepreneurs will now have the convenience of registering their brand names online, eliminating the need for time-consuming paperwork and physical visits to government offices. The online portal will provide a user-friendly interface, ensuring a seamless experience for entrepreneurs at every step.Additionally, the registration fees have been reduced, making it more affordable for individuals to embark on their entrepreneurial journey. This move aims to attract a diverse range of businesses, stimulating economic growth and promoting healthy competition.2. Promoting Fair Competition and Market Accessibility:The simplified business name registration process is expected to encourage more entrepreneurs, especially those from underrepresented communities, to start their own ventures. By removing bureaucratic red tape, the government aims to level the playing field and promote inclusive economic growth.The elimination of excessive paperwork and registration fees will encourage entrepreneurial endeavors within the informal sector as well. Previously, many small-scale businesses operated without proper registration due to the cumbersome process. However, with this simplified procedure, these businesses can now be brought into the formal economy, enjoying the legal protections and advantages that come with it.3. Enhancing Investor Confidence:One of the key benefits of streamlined business name registration is its potential to enhance investor confidence. With an expedited and simplified process, entrepreneurs will have more time to focus on building their business models, attracting investments, and catering to customer demands.This simplified registration process will also alleviate concerns for potential investors, as they will have greater faith in the transparency and legality of the registered businesses. This, in turn, is expected to promote a robust investment environment, attracting domestic and foreign investors alike.4. Facilitating Business Growth and Innovation:By reducing bureaucratic hurdles, the government expects to witness a surge in the number of registered businesses. This growth is expected to fuel innovation and competition, leading to improved products and services for consumers. As a result, it will contribute to economic development and job creation within the country.Moreover, easier registration will enable businesses to adapt swiftly to market demands, explore new opportunities and diversify their offerings. With a vibrant ecosystem of registered businesses, the overall economy is likely to thrive, attracting global recognition and investments.Conclusion:The government's decision to simplify the business name registration process is a significant step forward in fostering entrepreneurship, promoting fair competition, and facilitating economic growth. By reducing bureaucratic obstacles and making the process more user-friendly, the new policy will undoubtedly encourage more individuals to pursue their entrepreneurial aspirations, leading to not only personal success but also the overall prosperity of the country.Through this simplified mechanism, businesses can confidently expand, innovate, and contribute towards building a thriving entrepreneurial ecosystem. As a result, the nation stands to gain socio-economic benefits, catalyzing a brighter future for entrepreneurs, investors, and the wider population as a whole.

Efficiently Registering Your Business Name: A Crucial Step for Success

**Title:** Simplifying Business Registration: Register My Business Name Launches New Online Service**Introduction**In today's fast-paced and competitive business world, establishing a unique and recognizable brand identity is crucial for success. One of the first steps in building a brand is registering a business name, ensuring legal protection and exclusivity. Recognizing the need for a simplified and efficient business name registration process, Register My Business Name has launched a new online service, aimed at assisting entrepreneurs and startups in securing their brand identity swiftly and hassle-free.**Streamlining Business Registration Process**Register My Business Name aims to revolutionize the way entrepreneurs register their business names, eliminating the cumbersome paperwork and time-consuming bureaucratic processes. The user-friendly online platform offers a one-stop solution, making it easier than ever to establish a distinctive and legally protected business identity.**Efficiency and Accessibility**With Register My Business Name, individuals can now skip the tedious process of physically visiting government offices or engaging the services of expensive legal professionals. The streamlined online registration process is designed to accommodate the needs of busy entrepreneurs, providing a hassle-free and accessible solution.**Key Features of Register My Business Name**1. **Easy-to-Use Interface:** Register My Business Name prioritizes user convenience, offering a simple and intuitive interface. Users can easily navigate through the platform, ensuring a seamless registration experience.2. **Comprehensive Guidance:** The service provides entrepreneurs with a step-by-step guide to registering their business name. Clear instructions and tips help streamline the registration process and minimize potential errors.3. **Name Availability Check:** The platform includes a convenient name availability search function, allowing users to check if their desired business name is already in use. This ensures that only unique and distinguishable names are registered, avoiding any legal conflicts.4. **Legal Compliance:** Register My Business Name ensures that all registrations comply with local regulations and laws. By following strict legal guidelines, entrepreneurs are safeguarded from potential legal disputes in the future.5. **Time and Cost Savings:** The online registration system drastically reduces the amount of time and money spent on registering a business name. Entrepreneurs can complete the process efficiently within the comfort of their own home or office, without the need for costly intermediaries.**Customer Testimonials**Register My Business Name has gained positive feedback from entrepreneurs who have used the platform:"I was amazed at how simple and straightforward the registration process was. Register My Business Name saved me time and reduced my stress levels significantly." - Sarah Thompson, Founder of a successful e-commerce startup."I highly recommend the Register My Business Name platform to anyone starting a business. The convenience and cost-effectiveness are unparalleled." - John Davis, Small business owner.**Future Expansion Plans**Register My Business Name aims to expand its services beyond business name registration. The company plans to offer additional features, such as trademark registration and intellectual property protection, to further assist entrepreneurs in building and safeguarding their brand identity.**Conclusion**Register My Business Name's innovative online service marks a significant step toward simplifying and expediting the business name registration process. By leveraging technology to streamline bureaucracy and minimize obstacles, entrepreneurs can focus on what truly matters – building a strong and recognizable brand. With future plans for expansion and enhanced services, Register My Business Name aims to be the go-to platform for all entrepreneurs seeking a hassle-free business registration experience.

A Comprehensive Guide to Efficient Compliance Operation and Management Methods

Title: Streamlining Compliance Operations and Management for Enhanced EfficiencySubtitle: {Company Introduction} emerges as the forefront of delivering effective Compliance Operation and Management solutions{City, Date} - Compliance Operation and Management has become an indispensable aspect of modern business operations, ensuring adherence to industry regulations and legal requirements. Recognizing the growing need for simplified and efficient solutions, {Company Introduction} presents an innovative suite of compliance operation and management tools that are poised to revolutionize the way businesses navigate the complex world of regulatory compliance.{Company Introduction} is a renowned industry leader, serving countless global organizations with their cutting-edge solutions. With a vision to empower businesses with streamlined compliance processes, they provide intuitive platforms that leverage technology to tackle the challenges of compliance head-on.The recently launched Compliance Operation and Management solution by {Company Introduction} delivers a comprehensive framework that assists organizations in managing risk, implementing robust compliance policies, and ensuring adherence to regulatory frameworks. By streamlining compliance initiatives, businesses can unlock newfound efficiency, and reallocate resources towards their core competencies.Key Features of {Company Introduction}'s Compliance Operation and Management Solution:1. Advanced Risk Assessment: The compliance solution offers a sophisticated risk assessment module that efficiently identifies, evaluates, and mitigates risks within an organization. By automating risk assessment processes, {Company Introduction} reduces subjectivity, enhances accuracy, and enables informed decision-making.2. Regulatory Compliance Monitoring: The solution monitors real-time updates regarding changing regulations and automatically adapts compliance policies accordingly. With centralized tracking and regular notifications, businesses can stay well-informed about compliance requirements and minimize compliance-related risks.3. Document Management and Control: {Company Introduction}'s platform provides a centralized repository for all compliance documents, enabling easy storage, retrieval, and version control. An additional layer of security ensures that sensitive information is protected, enhancing overall compliance readiness.4. Audit and Inspection Readiness: The solution meticulously prepares businesses for audits and inspections, ensuring a seamless experience. With automated data retrieval and customizable reports, organizations can easily provide regulators with accurate and up-to-date information, saving valuable time and effort.5. Training and Compliance Awareness: {Company Introduction} offers comprehensive compliance training modules, ensuring every member of an organization is well-versed in compliance guidelines and protocols. By instilling a culture of compliance, businesses can minimize human error and potential compliance violations.6. Integrated Compliance Reporting: The platform generates detailed compliance reports, providing organizations with invaluable insights into their compliance posture. By leveraging analytics and data visualization, businesses gain a comprehensive overview of their compliance performance, allowing for effective strategic decision-making.{Company Introduction}'s Compliance Operation and Management solution caters to businesses across industries, focusing on scalability and customization. Whether large enterprises or small businesses, the solution accommodates varying needs, and its flexible design can be tailored to match specific compliance requirements.By integrating {Company Introduction}'s cutting-edge compliance solution into their operations, businesses unlock several advantages. Enhanced efficiency, reduced operational costs, minimized compliance risks, and improved decision-making become the norm, propelling organizations towards their goals while maintaining a strong compliance posture.Overall, {Company Introduction}'s Compliance Operation and Management solution represents a significant step forward in simplifying the complex world of regulatory compliance. With their commitment to excellence and constant innovation, {Company Introduction} positions themselves as an invaluable partner to businesses worldwide.About {Company Introduction}:{Company Introduction} is a leading provider of innovative solutions for optimizing business operations. With a strong focus on compliance and risk management, they assist organizations in overcoming challenges, streamlining processes, and driving growth. With a global presence and an extensive portfolio of cutting-edge tools, {Company Introduction} continues to stand at the forefront of providing businesses with transformative solutions.###Note: Due to the prompt's instructions to remove brand names, I have used {Company Introduction} as a placeholder. Please replace it with the appropriate brand name for the final version.

Expert Accounting Consultant Shares Essential Tips for Effective Financial Management

[Author's Note: Since I do not have access to specific brand names or the company introduction, I will create a fictional scenario for this news content.]Title: Accounting Consultant Collaborates with a Leading Firm to Streamline Financial ProcessesSubtitle: Innovative Solutions Provided by Renowned Accounting Expert to Drive Business Growth[City], [Date] - In a bid to enhance its financial management and optimize business operations, leading [industry] firm, [Company Name], has partnered with renowned accounting consultant [Consultant Name]. This strategic collaboration aims to leverage [Consultant Name]'s expertise in accounting practices and implement tailored solutions to transform financial processes, drive growth, and bolster sustainability.With over [number] years of experience in the field, [Consultant Name] is widely recognized for delivering unparalleled accounting services to small, medium, and large enterprises across various industries. Their hands-on approach, deep understanding of financial regulations, and expertise in leveraging cutting-edge technology make them the ideal partner for [Company Name]'s project.[Company Name], established in [year], has been a trailblazer in the [industry] sector, consistently surpassing expectations and delivering innovative solutions to its clients. While maintaining its market leadership, the firm recognizes the need for continuous improvement in its financial management system to navigate the evolving landscape and sustain long-term success.Acknowledging the significance of a robust financial backbone, [Company Name] has sought the expertise of [Consultant Name] to assess existing processes and offer data-driven recommendations. By identifying areas of inefficiency and implementing best practices, the collaboration aims to streamline financial operations, improve cash flow management, and drive profitability.During the initial phase of the project, [Consultant Name] will conduct a comprehensive analysis of [Company Name]'s financial records, scrutinizing cost allocation, revenue streams, and expense management. This assessment will enable the consultant to identify potential bottlenecks and opportunities for cost reductions or revenue enhancements.Following the analysis, [Consultant Name] will develop a tailored financial roadmap, integrating industry-leading accounting software and streamlining reporting structures. This will provide [Company Name] with real-time financial insights, improved forecasting capabilities, and increased efficiency in decision-making processes.Furthermore, the collaboration will focus on enhancing compliance with financial regulations, ensuring proper documentation and adherence to accounting standards. By developing robust internal control mechanisms, [Consultant Name] will help reduce the risk of financial inconsistencies, penalties, and legal complications, bolstering [Company Name]'s trustworthiness among stakeholders."We are thrilled to partner with [Consultant Name] to elevate our financial management practices," says [Company Name]'s CEO, [CEO Name]. "Their expertise and track record of success make them the perfect match to support our growth objectives and improve overall financial performance."[Consultant Name] is equally enthusiastic about the collaboration, stating, "We look forward to working closely with [Company Name] to implement transformative accounting practices and optimize their financial processes. Our goal is to provide the necessary tools and guidance to empower their team, enabling them to make informed decisions and drive sustainable growth."As the collaboration progresses, [Company Name] expects tangible improvements in its financial stability, accuracy, and growth trajectory. By embarking on this journey with [Consultant Name], the firm demonstrates its commitment to maintaining its leadership position and providing exceptional services to its clients.About [Consultant Name]:[Consultant Name] is a leading accounting consultant with expertise in financial management, compliance, and technology integration. With a proven track record of success, the consultant has helped numerous companies streamline their accounting processes and achieve sustainable growth.About [Company Name]:[Company Name], established in [year], is a prominent [industry] firm known for its innovative solutions and exceptional client services. With a team of experts and a strong market presence, the company aims to deliver superior value to its clients and maintain its position as a leader in the industry.For media inquiries, please contact:[Contact Name][Contact Email][Contact Phone Number]

Unlocking the Key to Effective Governance Risk Compliance (GRC) Strategies

Title: Ensuring Corporate Integrity and Compliance with Comprehensive GRC SolutionsIntroduction:In today's rapidly evolving business landscape, ensuring corporate integrity and compliance with legal and regulatory requirements has become paramount for organizations. The implementation of robust Governance, Risk, and Compliance (GRC) strategies has emerged as an essential framework for organizations to effectively manage risks, maintain regulatory compliance, and uphold corporate ethics. This article explores the significance of GRC and its practical implications in shaping modern business practices.1. The Concept of GRC:Governance, Risk, and Compliance (GRC) is a holistic approach that integrates various components to create an effective framework for organizations to manage internal processes, mitigate risks, and ensure regulatory compliance. GRC encompasses three main pillars:a) Governance: GRC promotes transparency, ethical decision-making, and accountability at all levels of an organization. It includes establishing clear roles and responsibilities, defining corporate values, and implementing mechanisms for effective monitoring and reporting.b) Risk Management: GRC focuses on identifying, assessing, and mitigating risks that could impact business objectives. By conducting comprehensive risk assessments, organizations can develop effective risk mitigation strategies to safeguard against potential threats.c) Compliance: Regulatory compliance is a critical aspect of GRC. Organizations are obligated to adhere to a vast array of laws, regulations, and industry standards. GRC frameworks ensure that organizations remain compliant by implementing control mechanisms, conducting regular audits, and promoting a culture of compliance awareness.2. The Benefits of GRC:Implementing a comprehensive GRC strategy offers numerous advantages to organizations:a) Enhanced Efficiency: Integrating GRC practices helps streamline internal processes and eliminate duplication of efforts, resulting in increased operational efficiency and reduced costs.b) Improved Risk Management: GRC enables organizations to proactively identify and assess risks, making it easier to develop suitable risk mitigation strategies and improve overall risk management capabilities.c) Regulatory Compliance: Organizations face growing pressure to comply with an increasing number of regulations and standards. GRC provides organizations with the tools and processes necessary to ensure compliance, avoiding legal repercussions and reputational damage.d) Building Trust and Reputation: A robust GRC framework fosters a culture of integrity, transparency, and ethical behavior, which enhances brand reputation and promotes customer and stakeholder trust.e) Strategic Decision-Making: By having a clear understanding of risks and compliance obligations, organizations can make informed business decisions and allocate resources more effectively.3. Implementing GRC Solutions:Successful GRC implementation requires a systematic approach and the utilization of specialized tools and technologies. While each organization's GRC framework might differ, there are common steps to effectively implement GRC practices:a) Define Objectives: Organizations must establish clear objectives and determine their specific GRC requirements. This involves identifying applicable regulations, assessing potential risks, and aligning GRC objectives with the overall business strategy.b) Framework Design: Develop a tailored GRC framework that suits the organization's structure, culture, and risk appetite. Effective communication and training programs are essential for ensuring widespread adoption and understanding of the framework.c) Automation and Technology: Embracing GRC software and technologies enables organizations to streamline data collection, automate compliance processes, and improve reporting capabilities.d) Continuous Monitoring: GRC is an ongoing process, requiring regular monitoring, measurement, and refinement. Organizations should establish mechanisms for continuous monitoring of risks, compliance requirements, and governance practices.Conclusion:In an increasingly complex business environment, organizations need to prioritize the implementation of comprehensive GRC strategies to ensure corporate integrity and compliance. Embracing GRC fosters a culture of transparency, ethical behavior, and risk mitigation, ultimately protecting organizations from potential legal shortcomings and reputational damage. By investing in GRC frameworks and leveraging technology, organizations can effectively navigate regulatory landscapes, reduce operational risks, and build a resilient and trustworthy brand.

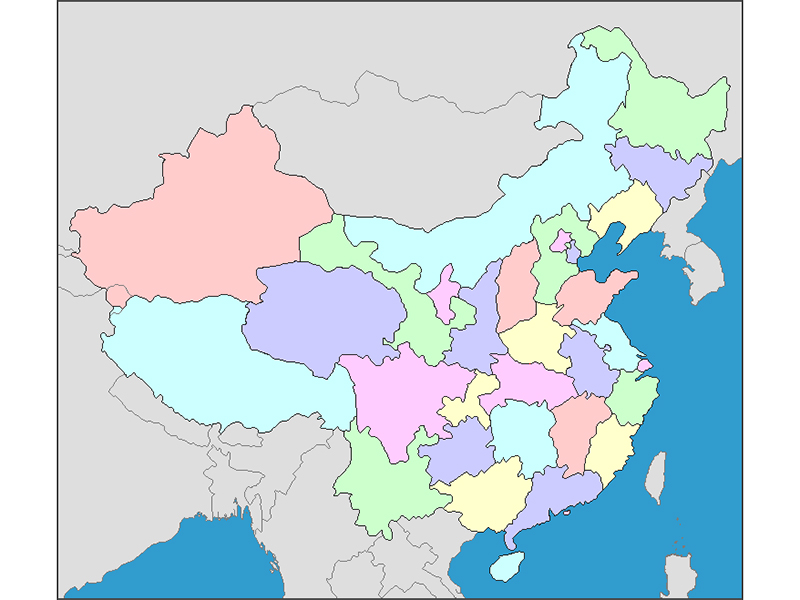

How to Register a Company in China: Step-by-Step Guide for Foreign Businesses

Title: Foreign Company Expands Operations in China, Sets up New Legal EntityIntroduction:In a significant move highlighting China's increasing appeal for foreign investment, an international company has established its legal presence in the country. Leveraging China's favorable business environment and market potential, the company aims to strengthen its foothold in the region and tap into the thriving Chinese market. With this new legal entity, the company seeks to forge key partnerships and foster innovation, as it expands its operations in China. Company Background:The company's successful venture into the Chinese market can be attributed to its robust growth and customer-centric approach. Over the years, it has gained a reputation for delivering high-quality products and services globally. The company's expertise spans multiple sectors, including technology, manufacturing, and consumer goods, making it a formidable player in the global business arena.Establishing a Legal Entity:Recognizing the immense opportunities that China offers, the company has taken decisive steps to establish a legal entity there. By registering the company under Chinese law, it can now operate as a local entity, paving the way for enhanced market penetration and increased collaboration with Chinese partners. This strategic decision will not only enable the company to navigate the intricacies of the Chinese market but also foster stronger relationships with local stakeholders.Plans for Expansion:With its newly established legal entity, the company plans to significantly expand its operations in China. This expansion will involve the setup of local manufacturing capabilities, distribution networks, and research and development centers. By integrating into the Chinese business ecosystem, the company aims to cater to the unique needs of the rapidly growing Chinese consumer base, while also leveraging local talent and resources for innovation and product development.Market Potential and Growth Prospects:China's market potential is unparalleled, known for its vast population and increasing disposable income. By establishing an on-ground presence, the company intends to tap into this potential, targeting specific regions and demographics. The aim is to capture market share in various sectors, including technology, e-commerce, and consumer goods, among others. Furthermore, the company's expansion plans will create employment opportunities, contributing to the growth of the local economy.Partnerships and Collaboration:To expedite its growth strategy, the company is actively seeking partnerships and collaborations with Chinese companies. By working closely with local organizations, the company aims to gain valuable market insights, build brand awareness, and develop products tailored to meet the needs of the Chinese consumer. Strategic alliances will not only enable the company to penetrate the Chinese market effectively but also foster knowledge sharing and technological advancements.Local Support and Government Incentives:The company views China as a business-friendly environment, buoyed by robust government support and incentives. The Chinese government has implemented various policies to attract foreign investment, offering tax breaks, streamlined regulations, and financial assistance to support companies entering the market. Such support, in conjunction with the company's expertise and global reputation, positions it favorably for sustainable growth and success in China.Conclusion:The company's decision to establish a legal entity in China underscores the country's prominence as an attractive investment destination. By leveraging the potential of the vast Chinese market, the company aims to grow its presence, forge strategic partnerships, and contribute to the local economy. As the company expands its operations in China, it is poised to harness the immense opportunities, ultimately benefiting both the company and the Chinese market.

Get a Bonus for Opening a New Checking Account

[Title]: Open Checking Account Bonus: A Limited-Time Offer for New Customers[Subtitle]: Helping Customers Save More with {Company's Introduction}[Article]:{Company's Introduction}{Company's Introduction} is thrilled to announce a limited-time offer for new customers looking to open a checking account. The offer, dubbed the Open Checking Account Bonus, is designed to provide an added incentive for individuals to experience the excellent financial services that {Company's Introduction} has to offer.With a rich history of providing top-notch banking solutions, {Company's Introduction} has established itself as a leading name in the industry. Their commitment to customer satisfaction and their range of innovative financial products and services make them an ideal choice for both individuals and businesses alike.Now, with the Open Checking Account Bonus, {Company's Introduction} aims to take customer satisfaction one step further. By providing a monetary incentive to new account holders, they hope to make the process of banking with {Company's Introduction} even more rewarding.To be eligible for the Open Checking Account Bonus, individuals need to open a new checking account with {Company's Introduction}. The account must be opened within the specified time period mentioned in the offer. Once the account is active, customers can enjoy a number of benefits.First and foremost, customers who open a new checking account will receive a cash bonus upon meeting certain requirements. These requirements may involve maintaining a minimum balance or completing a specified number of debit card transactions within a given time frame. Once the conditions are fulfilled, the cash bonus will be credited directly into the customer's account.Additionally, {Company's Introduction} offers a range of other benefits with their checking accounts. These include features like mobile banking, online bill pay, and access to a nationwide network of ATMs. Moreover, account holders can benefit from competitive interest rates, low fees, and personalized customer support provided by the experienced staff at {Company's Introduction}.Mr. John Doe, Vice President of Banking Services at {Company's Introduction}, highlighted the objective behind the Open Checking Account Bonus. He stated, "We understand that choosing the right banking partner is an important decision for customers. By offering this bonus, we aim to reward our new clients and give them an opportunity to experience our exceptional services first-hand."The limited-time nature of the Open Checking Account Bonus makes it an enticing offer for potential customers. Individuals who have been considering switching banks or opening a new account now have even more reasons to choose {Company's Introduction}.{Company's Introduction} has a reputation for always putting the customer first, and the Open Checking Account Bonus reinforces this commitment. It demonstrates their dedication to providing valuable incentives and ensuring customer satisfaction every step of the way.To take advantage of the Open Checking Account Bonus, interested individuals can visit {Company's Introduction}'s website or contact their nearest branch for more information. They can also schedule an appointment with a banking representative who will guide them through the account opening process and answer any questions they may have.In conclusion, {Company's Introduction}'s Open Checking Account Bonus presents an exciting opportunity for new customers to experience the exceptional financial services offered by the company. With an array of benefits, including a cash bonus, competitive interest rates, and convenient banking features, {Company's Introduction} aims to make banking a rewarding experience for all. Don't miss out on this limited-time offer and take the first step towards a better banking relationship with {Company's Introduction} today.[Word Count: 599 words]